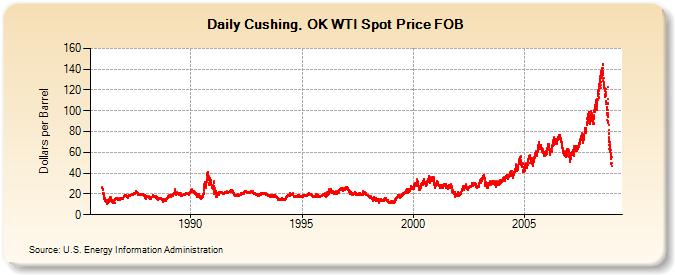

When crude prices hit unprecedented highs last summer, followed closely by gasoline and diesel, consumers reacted by driving less and conserving more.

Then prices began an equally dramatic fall to levels not seen since 2004, exacerbated by the growing global recession.

However, increasing delays in new production projects could create an energy crunch and choke off an economic recovery when demand rebounds, Richard Jones, deputy executive director of the International Energy Agency, said Tuesday in a presentation at Rice University’s James A. Baker III Institute for Public Policy.

"We believe these developments have diverted world attention from energy security and climate change," he said. "In times of economic hardship, it’s all too easy to lose sight of longer-term concerns."

The IEA’s 2008 World Energy Outlook, compiled in the first half of this year as oil marched toward the $140s, calls for worldwide energy investments of $26.3 trillion through 2030, or more than $1 trillion each year. It also says under current policies, global demand will rise 1.6 percent a year, or 45 percent by 2030.

"We don’t think current worries justify backtracking or delay," Jones said Tuesday. "Investment will be a sound way to increase jobs and get out of the economic crisis we’re in."

No comments:

Post a Comment